Platform Capabilities & Adoption

Supporting diverse loan products including microfinance, MSME loans, mortgages, and consumer durable financing, nPOS has become the preferred solution for building retail credit portfolios. In FY2023, the platform facilitated ₹159,636.69 million in transactions across 21 active partner institutions.

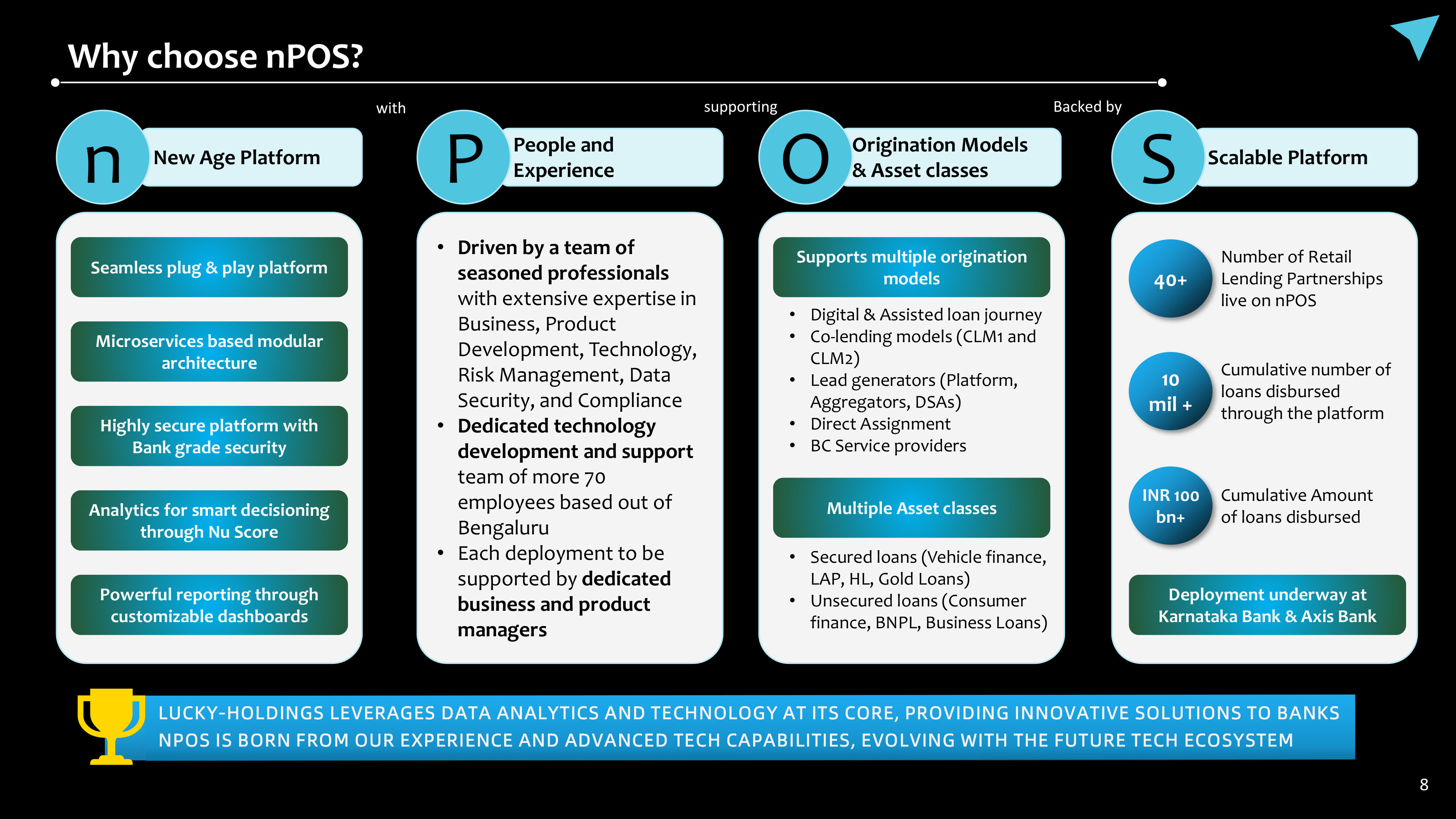

Technical Architecture Highlights

- Deployment flexibility: Available as hosted PaaS or enterprise-installed solution

- Omnichannel origination: Mobile apps, co-lending models, direct assignments, and BC networks

- Deep ecosystem integration: India Stack, credit bureaus, and government databases

- Universal protocols: Standardized processes for all secured/unsecured loan products

- Advanced security: Multi-factor authentication and end-to-end encryption

- AI-powered underwriting: Customizable rule engines evaluating 100+ parameters

- Machine learning-enhanced risk analytics

In Fiscal 2023, nPOS received the SOC 2 type II attestation from the American Institute of Certified Public Accountants and SOC 1 type II audit for adherence to the International Auditing and Assurance Standards Board’s International Standard of Assurance Engagement 3402 standards.