Growth Engine

LUCKY-HOLDINGS employs a specialized credit evaluation framework to select and develop Originator Partners through our lending operations, targeting customer-centric organizations committed to serving underserved markets and demonstrating scalable potential with debt financing. These partners, typically emerging financial providers with limited access to institutional funding, enable us to cultivate enduring relationships with early-mover benefits, creating mutual value as they expand their operations and financing needs over time.

Through our data-driven digital platforms, we've transformed 19,273+ lives across key sectors via integrated financial channels.

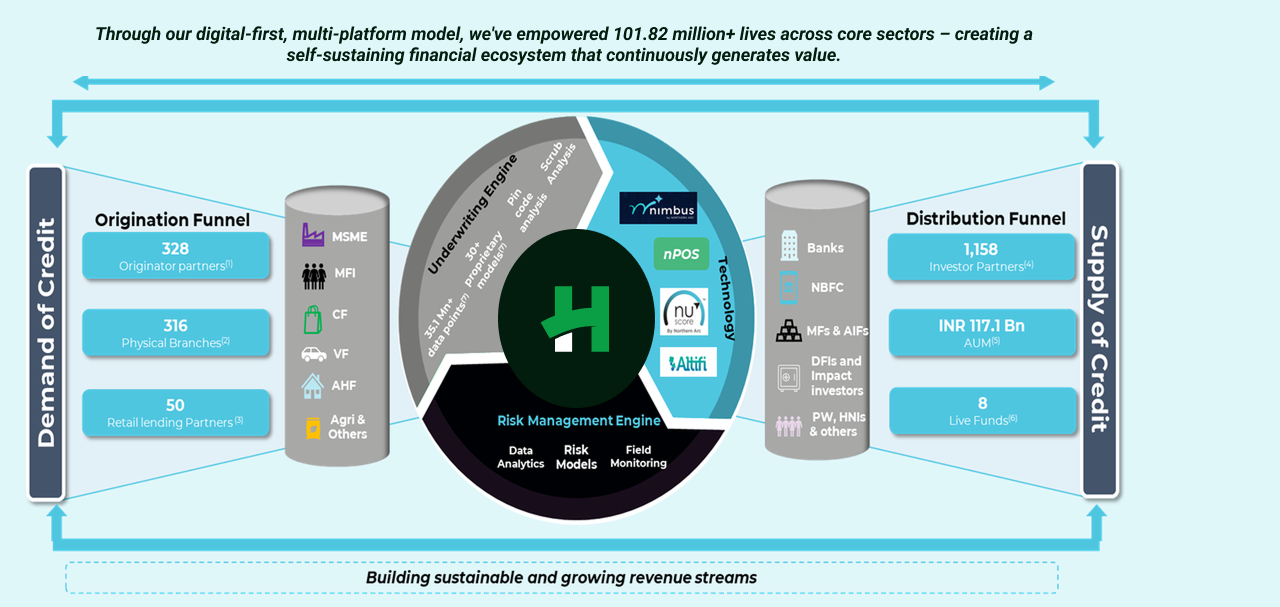

Through our digital-first, multi-platform model, we've empowered 101.82 million+ lives across core sectors – creating a self-sustaining financial ecosystem that continuously generates value.

Our integrated financial ecosystem connects all market participants through innovative solutions. We collaborate with Retail Lending Partners to serve end borrowers, handling the complete loan lifecycle from origination to collections. Through our Capital Markets Solutions channel, we address Originator Partners' diverse funding needs via on-balance sheet lending and structured solutions like securitization, direct assignments, and debt syndication. Our platform brings together a wide spectrum of Investment Partners - including institutional investors, global funds, and private wealth managers - creating pathways to finance India's underserved segments.

We provide Investor Partners with: comprehensive due diligence, customized underwriting, active portfolio monitoring, aligned co-investment structures, and efficient execution capabilities. Our Fund Management channel further deploys capital through AIFs to selected Originator Partners and businesses.

Technology powers our ecosystem: The Nimbus platform facilitates seamless debt transactions across all partners, while our proprietary NuScore machine learning tool enhances credit decision-making. Our API-based nPOS solution streamlines co-lending processes, and the Altifi platform expands retail investor participation - creating a pipeline for future institutional investors.

This multi-channel model, supported by cutting-edge technology, generates a virtuous cycle: as transaction volumes grow, enhanced data flows strengthen underwriting capabilities, attracting more participants and capital to the ecosystem. The resulting flywheel effect continuously expands financial access while creating value for all partners.